It’s been a bloody two days so far into this early 2018 Bitcoin crash and cryptocurrency bloodbath.

Have we learned any lessons here?

One of the best recommendations that I can make after experiencing this is to know your history! It has been said over and over that those who fail to understand history are doomed to repeat its mistakes.

There was never a truer phrase than now, and especially in Bitcoin and Cryptocurrency Land.

So many people never saw this coming, and those who did were shouted and modded down as trolls and negatrons.

Lesson One: Don’t crowd out the unpopular opinions.

Now, there are exceptions here. There will always be those who are just trolling or those who hate Bitcoin and Cryptocurrency and will have nothing constructive or positive to say, ever. Those are pretty easy to identify. They are out in full force in the article comments sections today, bashing and saying that Bitcoin and crypto are worthless, pumping gold and silver. Hey, I love Gold and Silver, but those assets will only store value and in the worst of normal times double value, but they don’t provide the money multiplying leverage that cryptocurrencies have been providing. In most cases, you aren’t going to 5 or more times your money in a matter of weeks or months using Gold or Silver.

M’kay?

There are those who have measured sober opinions who should be given attention, however. They provide balance in times of “irrational exuberance”. Taking a portion of your earnings and placing it into something like Tether in the days before this downturn would have proven very useful when the bloodshed is over, allowing one to buy everything on sale for the ride back up.

Think about that.

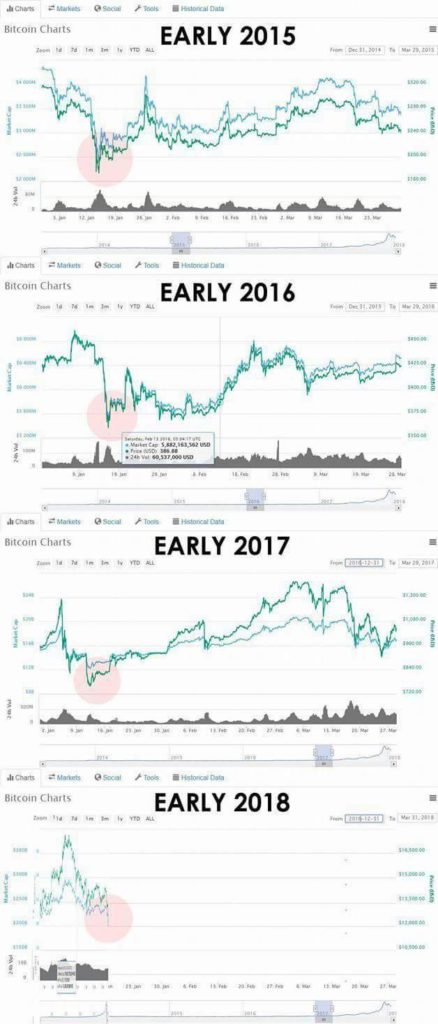

Lesson Two: Analyze historical price charts.

When everyone started looking around asking what is causing this and wondering how this happened, an interesting chart surfaced, showing the Bitcoin prices had a major downturn in every January, going back a few years.

To make sure that this was true and not some Photojob, I looked myself and verified it as true. The Bitcoin price plunged in every January going back to at least 2015! Another funny thing is that if yo stretch out the increment to six months you don’t always see it. If you shrink the chart window to a month or two, it’s right there in your face.

See my video on this.

Had we all known this, and even an 8 figure guy who I know DIDN’T, we could have taken some precautions to preserve some, or all, gains. Those gains could have then been used to buy back in at historic low levels, which I am sure many a crypto whale is doing.

Lesson Three: You only truly lose if you sell, or the asset becomes worthless.

This one is a Catch 22 of sorts. It can be a trap, or a test of resolve.

Those who panic sell are showing no confidence in their investment. They lack true belief and only hold because they hope to make a profit. Once there is a downturn that turns into a major correction or route, they panic sell, trying to preserve any portion of their investment, even at a loss.

This isn’t to say that everyone who is in it to make money is one of these.

Many invest in things they believe in and technologies that have good use cases that they believe in, with the added hope that they can make a profit.

The former are a cancer to the market.

The latter are just normal well adjusted investors.

The former group turns a regular downturn into a stampede.

They need to learn that most of these cycles are just that, cycles. The market goes up, down, then up again, etc. You only lose if you sell low. If you hold and wait, you can make it all back and more.

Don’t be a weak handed panicky low seller. If you are, don’t be a complainer because you only have yourself to blame for your ultimate losses. Also, don’t go crying to the government that you were scammed. Put on some resolve and learn to do it right, or get out of the market and go invest in a savings account that will never lose money ,and you might get a quarter of a percent interest while you’re at it.

How many lessons can we come up with here? I’m sure many more, but I’m already thinking about the next thing and this is the crux of what I wanted to communicate with this post.

Listen to voices of reason but ignore blatant trolls, believe in what you invest in, be strong and not panicky, remember that in most cases you only lose if you sell lower than your entry price, and pay attention to history so that you can at least try and be ready for these inevitable downturns and turn a bloodbath into a profitable experience!

Remember the main page has constantly updated sector news!